Keeping Up With the Fraudsters

You can't get ahead of the fraudsters if your fraud risk management program is two steps behind. That's why it's critical to understand emerging trends and tactics in order to update your program to be responsive to evolving threats.

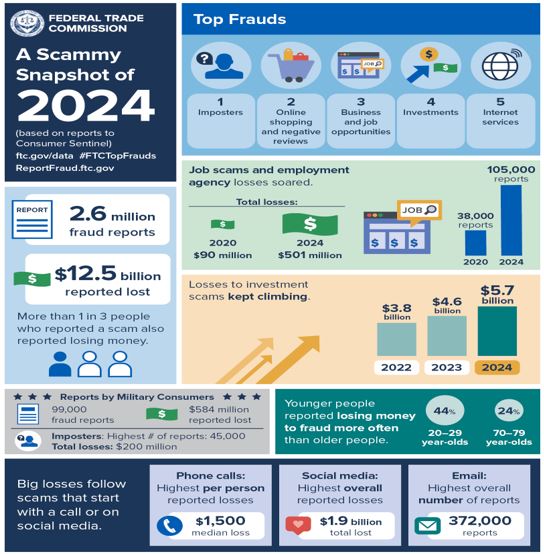

On March 10, 2025, the Federal Trade Commission (FTC) issued new data that shows a big jump in reported losses to fraud in 2024. The $12.5 billion that consumers reported losing represents a 25% increase over 2023. While the number of fraud reports remained stable year-over-year at 2.6 million, the percentage of people losing money to a fraud or scam increased by double digits, from 27% to 38%.

Investment scams topped the list at $5.7 billion lost in 2024, with imposter scams following closely behind with $2.95 billion lost. The Director of the FTC's Bureau of Consumer Protection, Christopher Mufarrige, had this to say: "The data we're releasing today shows that scammers' tactics are constantly evolving."

Let's dig deeper into that data. The most common fraud schemes are hidden in many forms: imposter scams, online shopping, business/job opportunities, as well as investments and internet services scams. Focusing in on job and employment agency scams, these losses soared, from 38,000 reports and $90 million in losses in 2020, to 105,000 reports and $501 million in losses in 2024.

Scammers used the email channel most often, followed by phone calls and text messages. The email channel had the highest number of reports at 372,000, while phone calls had the highest per person loss at $1,500 median loss. Social media channels reported the highest overall reported losses at $1.9 billion total lost.

Banks' filing of suspicious activity reports (SARs) increased slightly last year, which correlates with a slight increase in instances of fraud reported by banks in 2024 as compared to 2023. Among these, wire fraud saw a sharp increase while check, loan and card fraud declined. Consumers reported losing more money to scams where they paid with bank transfers or cryptocurrency than all other payments combined. (For more granular fraud SAR data, see AFC Bulletin: U.S. Fraud Trends (2020-2024.)

New this year, the FTC has provided a Tableau Public Landing Page and new features to allow users to sort the data by age and state as well as a number of subcategories. There are also infographics and other visualizations available for download.

Under-Reporting by Older Adults

The FTC's data reflects that younger people reported losing money to fraud more often than older people, at 44% in the 20 - 29-year-old cohort as compared to 24% among 70 - 79-year-olds. However, this statistic could be a skewed in a couple of ways. For example, there may be more younger people purchasing online than older people, and it's possible that fraud occurring among the older population may be unnoticed and/or under-reported.

The National Adult Protective Services Association estimates that only 1 in 44 elder financial abuse cases is reported, as older adults may hesitate to report financial exploitation due to shame or embarrassment, the abuse may take place little by little over time, the abuser is a trusted family member or caregiver, or they don't know how or where to report the abuse.

This is confirmed in FTC's October, 2024 report Protecting Older Americans. Reporting on 2023 data, it states that older adults reported losing $1.9 billion; however "because the vast majority of frauds are not reported," the FTC estimates the cost may be as high as $61.5 billion. This suggests that 97% of fraud losses among older adults are unreported! Therefore, financial institutions should take this into consideration when analyzing data.

The report shows that older adults reported losing far more money to fraud using bank transfers and cryptocurrency than any other methods of payment. Reports indicating cryptocurrency as the payment method often involved the use of Bitcoin ATM machines. Gift cards continued to be the most frequently reported payment method on a number of common fraud types, including tech support scams and family and friend impersonation scams.

Dementia's Financial Toll

To complicate matters further, older adults may simply not realize that they are being scammed or are experiencing cognitive issues that impact their financial decisions. Groundbreaking work by the American Association of Retired Persons (AARP) and the Massachusetts Institute of Technology (MIT) AgeLab was published in Before the Diagnosis: Dementia's Early Financial Toll (January 7, 2025.)

The researchers noted that the impact of dementia is broad, affecting 1 in 10 U.S. adults over the age of 65. However, they found that more than 2 in 10 older adults have mild cognitive impairment (MCI) that often precedes a diagnosis of dementia. Researchers are now beginning to understand that there may be early, harmful financial impacts occurring during this earlier period of mild memory or cognitive decline in the several years before a dementia diagnosis.

For example, the report references one study that showed patterns of missed payments and declining credit scores that can precede a full diagnosis of dementia by as much as six years. Another study confirmed these results and found that the median household net worth of older adults drops by more than half in the eight years leading up to a dementia diagnosis, from a median level of $217,000 to around $104,000. Some of these losses could result from lost income, while reduced financial judgment is also a primary driver of pre-dementia financial losses.

Fraud and elder exploitation may exacerbate financial loss during periods of MCI. Artificial Intelligence (AI) can make scams more convincing than ever, especially imposter scams using the voice of a family member or loved one. In a "grandparent's scam," the fraudster pretends to be a loved one in distress, requesting money to get them out of an awful predicament like a car accident or arrest.

Financial loss during this later stage of life can be cataclysmic to older adults. Research points to a vicious cycle that exists between financial and cognitive losses, with cognitive losses leading to financial loss, and then the stress of financial loss leading to increased cognitive impairment.

The World Health Organization (WHO) estimates that as of 2023, there are 55 million people globally that live with dementia, and that could triple by 2050. With financial impacts that can begin up to six to eight years before an official dementia diagnosis, and as the baby boomer cohort ages, this creates a very large vulnerable population at risk of financial exploitation.

Financial institutions (FIs) may want to educate their staff and customers on evolving risks to older adults and consider enhancing risk mitigation tactics with proactive measures to help address this growing problem. An important resource for FIs is the CFPB's Working with Older Adults resource page, which contains resources and a link to the Interagency Statement on Elder Financial Exploitation of December 4, 2024. A FinCEN financial trend analysis of Bank Secrecy Act reports over a one-year period ending in June 2023 found that about $27 billion in reported suspicious activity was linked to elder financial exploitation.

Banks, credit unions, and other financial institutions play an important role in combating elder financial exploitation and supporting their customers who experience these crimes. The interagency statement provides examples of risk management and other practices that FIs may use to help identify, prevent, and respond to elder financial exploitation, including but not limited to:

- Developing effective governance and oversight, including policies and practices to protect account holders and the institution,

- Training employees on recognizing and responding to elder financial exploitation,

- Using transaction holds and disbursement delays, as appropriate, and consistent with applicable law,

- Establishing a trusted contact designation process for account holders,

- Filing suspicious activity reports to FinCEN in a timely manner,

- Reporting suspected elder financial exploitation to law enforcement, Adult Protective Services, and other appropriate entities,

- Providing financial records to appropriate authorities where consistent with applicable law,

- Engaging with elder fraud prevention and response networks, and

- Increasing awareness through consumer outreach.

AI Scams and Spoofing

As mentioned above, advances in AI are leading to an increase in "call spoofing" - where threat actors commit fraud by imitating a person's voice on the phone. A recent report on cyberattack trends found that the financial services industry is the most impersonated industry by fraudsters. Scammers falsify Caller ID and sometimes also the FI's phone number to spoof victims into believing that they are being called by a bank's fraud department warning the bank customer that there has been fraudulent activity on their account in order to obtain their personal banking information. In some cases, they obtain information such as Zelle® or Venmo account data. This brand spoofing leverages the FI's brand and reputation to make their scams more convincing and effective.

Call spoofing and voice cloning can happen to anyone, at any age, even to bank employees. There is the case reported by CNN in February 2024 of a Hong Kong finance worker at a multinational firm that fell prey to a deepfake video conference call scam, resulting in the loss of $25 million. He attended a meeting where the attendees looked and sounded like his coworkers, including the company's Chief Financial Officer. They were all fakes.

AI deepfakes can also use stolen identity cards and publicly available information to trick facial recognition programs, create synthetic identities, and sponsor fake websites. As these fraudsters become more sophisticated, FIs must keep pace with training and technology to detect these emerging risks.

Proactive Fraud Risk Management

Fraudsters are not afraid to try new tactics or leverage new technologies. Banks need to be just as creative and adept at leveraging AI and other technologies as important tools to address fraud in real-time. However old-school tactics should also remain part of the toolkit.

Consumer education remains a critical tactic to help customers understand these new threats and what they can do to protect themselves. Educating customers to "pause" before reacting, hang up the telephone, and call "official" numbers to validate messaging is simple yet effective. (This is especially important for older Americans, who may think it's rude to hang up on a caller.) Partnering with community organizations and agencies that focus on more vulnerable populations can help spread the word.

One large bank employed a creative approach after learning that nearly 50% of their payment scams originated on social media - they issued a "Social Media Warning" to customers and changed their policy such that they would not allow customers to send Zelle payments originating through social media. (See BOL article Zelle - A Fast and Easy Path to Compliance Concerns 2/21/25.)

One thing is for sure - fraudsters are not going anywhere. Over the centuries, con artists have always lingered in the shadows, trying to separate gullible individuals from their hard-earned money. FIs must remain vigilant, protect their customers and their reputations, and sufficiently enhance their fraud risk management program to stay one step ahead of the fraudsters.

FTC Graphic:

print

print share

share