Rising Threat: Bank Impersonation Scams

In today's digital landscape, impersonation scams are a growing threat, targeting both individuals, businesses, and banks. The FTC reported that in 2023, business impersonation scams, which include bank impersonation, accounted for over 330,000 reports, contributing to nearly half of all frauds reported directly to the agency. Combined losses from business and government impersonation scams exceeded $1.1 billion in 2023, more than triple the losses reported in 2020.

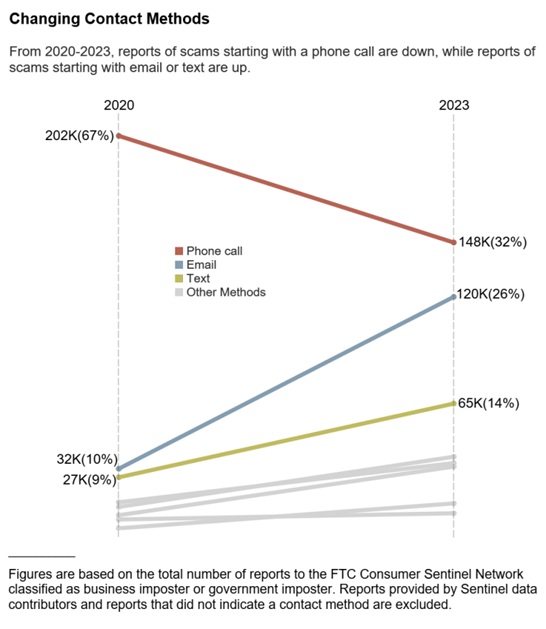

According to the FTC, scammers have changed their modus operandi. Between 2020 and 2023, reports of scams initiated by phone calls dropped significantly, while scams originating through texts and emails surged. During this time, reported losses from bank transfers and cryptocurrency transactions soared.

This trend has continued in 2024, with financial institutions and consumers experiencing increased fraud attempts. Over half of banks, fintechs, and credit unions reported a rise in both business and consumer fraud. Notably, 35% of these institutions faced over 1,000 fraud attempts in the past year, and 1 in 10 encountered more than 10,000 attempts.

Our elder population is particularly at risk for impersonation scams. The FBI recently issued an alert warning seniors of government and tech support impersonation scams. According to the FBI's Internet Crime Complaint Center (IC3), South Carolina seniors, those 60 and older, have reported losses of more than $9 million to tech support scams from January through November.

While these scams are not new, they have become increasingly sophisticated and usually involve a network of criminals. These schemes are multi-layered and may go undetected for several weeks or even months before victims realize they are being scammed and their financial accounts have been depleted. Fraudsters are leveraging advanced technologies like AI to mimic trusted individuals or organizations, leading to significant financial and reputational damage.

To combat the growing trend of bank impersonation scams, it is essential that financial institutions adopt a multi-layered approach combining technology, consumer education, and robust internal processes. Following are some strategies financial institutions can implement:

Enhance Fraud Detection and Prevention Systems

- AI and Machine Learning: Utilize advanced algorithms to detect unusual patterns, such as abnormal transaction behaviors or phishing attempts.

- Real-Time Alerts: Implement real-time monitoring systems that flag and block suspicious activities immediately.

- Biometric Authentication: Introduce stronger customer authentication measures like facial recognition, fingerprint scanning, or voice verification.

Collaborate with Industry and Regulators

- Information Sharing: Partner with other banks, fintechs, and industry bodies to share insights and trends about new scam tactics.

- Regulatory Compliance: Work closely with regulators to align fraud prevention strategies with evolving legal standards.

- Law Enforcement Cooperation: Collaborate with authorities to identify and prosecute scammers.

Improve Internal Security Protocols

- Employee Training: Regularly train employees on fraud prevention, detection, and customer communication.

- Regular Audits: Conduct frequent audits to identify and address potential vulnerabilities in systems and processes.

- Incident Response Plans: Develop comprehensive response plans to mitigate the impact of successful scams.

Adopt Advanced Verification Methods

- Two-Factor Authentication (2FA): Enforce 2FA for all sensitive transactions.

- Transaction Verification: Require confirmation for large or unusual transfers, such as callbacks or app-based approvals.

Educate and Empower Customers

- Awareness Campaigns: Launch targeted campaigns to educate customers about common scam tactics and warning signs.

- Communication Guidelines: Regularly remind customers that banks will never ask for sensitive information like passwords or OTPs through phone calls, texts, or emails.

- Fraud Simulations: Provide interactive tools or workshops that simulate phishing attempts to help customers recognize scams.

By staying vigilant and proactive, banks can mitigate the impact of impersonation scams and foster stronger trust with their customers.

print

print share

share